property tax calculator frisco tx

Enter your Over 65 freeze year. Property Tax Calculator Frisco Rmends Raising Property Taxes Texas Scorecard Frisco Property Taxes PISD adopts same tax rate for fifth year in a row Plano Star Courier.

Taxes Celina Tx Life Connected

361 417 more Federal Income Tax.

. Enter your Over 65 freeze amount. Real property tax on median home. Tax Code Section 1113 b requires school districts to provide a 25000 exemption on a residence homestead and Tax Code Section 1113 n allows any taxing unit to.

The frisco texas sales tax is 825 consisting of 625 texas state sales tax and 200 frisco local sales taxesthe local sales tax consists of a. Property taxes in America are collected by local governments and are usually based on the value of a property. The Frisco Sales Tax is.

6101 Frisco Square Boulevard. Sales Tax State Local Sales Tax on Food. Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

Creating property tax rates and directing appraisals. Loading Do Not Show Again Close. Collin County Tax Assessor Collector Office.

Enter your Over 65 freeze amount. The Frisco Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Frisco local sales taxesThe local sales tax consists of a 200 city sales tax. Taxing entities include Frisco county governments and numerous special districts like public colleges.

Enter your Over 65 freeze amount. For comparison the median home value in Texas is 12580000. Along with collections property taxation takes in two additional common functions.

The median property tax in Collin County Texas is 4351 per year for a home worth the median value of 199000. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and. Homes in frisco collin county prosper isd.

Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Frisco texas and little elm texas change places.

For more information call 469. Frisco Property Taxes City of Frisco Raised Taxes 38 Percent Over Last Five Years. All are legal governing units administered by elected or appointed officers.

Over 65 65th birthday 30000. Sales Tax State Local Sales Tax on Food. Enter your Over 65 freeze year.

For more information call 469. Collin County collects on average 219 of a propertys assessed fair. 15910 Trail Glen Dr Frisco TX 75035-1651 is a single-family home listed for-sale at 495000.

Frisco Rmends Raising Property Taxes Texas Scorecard Frisco property tax rate to remain unchanged for 2020. Property tax in texas is a locally assessed and locally administered tax. 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034.

Property Tax Calculator Frisco Real Estate Market Trends. Skip to Main Content. Tax Data Requests.

Property taxes are determined by what a property is used. Enter your Over 65 freeze year. Discover how to pay property taxes and more.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Budget And Tax Facts City Of Lewisville Tx

What Is The Property Tax Rate In Frisco Texas

Budget And Tax Facts City Of Lewisville Tx

Nextdoor Neighbor Posted This Picture Of Bobcat In Their Backyard In Frisco Tx Bobcat Pictures Picture Animal Pictures

Why Are Texas Property Taxes So High Home Tax Solutions

How To Value Your House And Split Equity In Divorce

Can And Should You Pay Your Own Property Taxes Part Time Money

Where Are Lowest Property Taxes In North Texas

Homes Located In Top Notch Rated School Zones At The Home Solutions Realty Group We Know How Important It Is To Have Home Buying Fox Home Houston Real Estate

Why Does Texas Have High Property Taxes Quora

Cook County Il Property Tax Calculator Smartasset

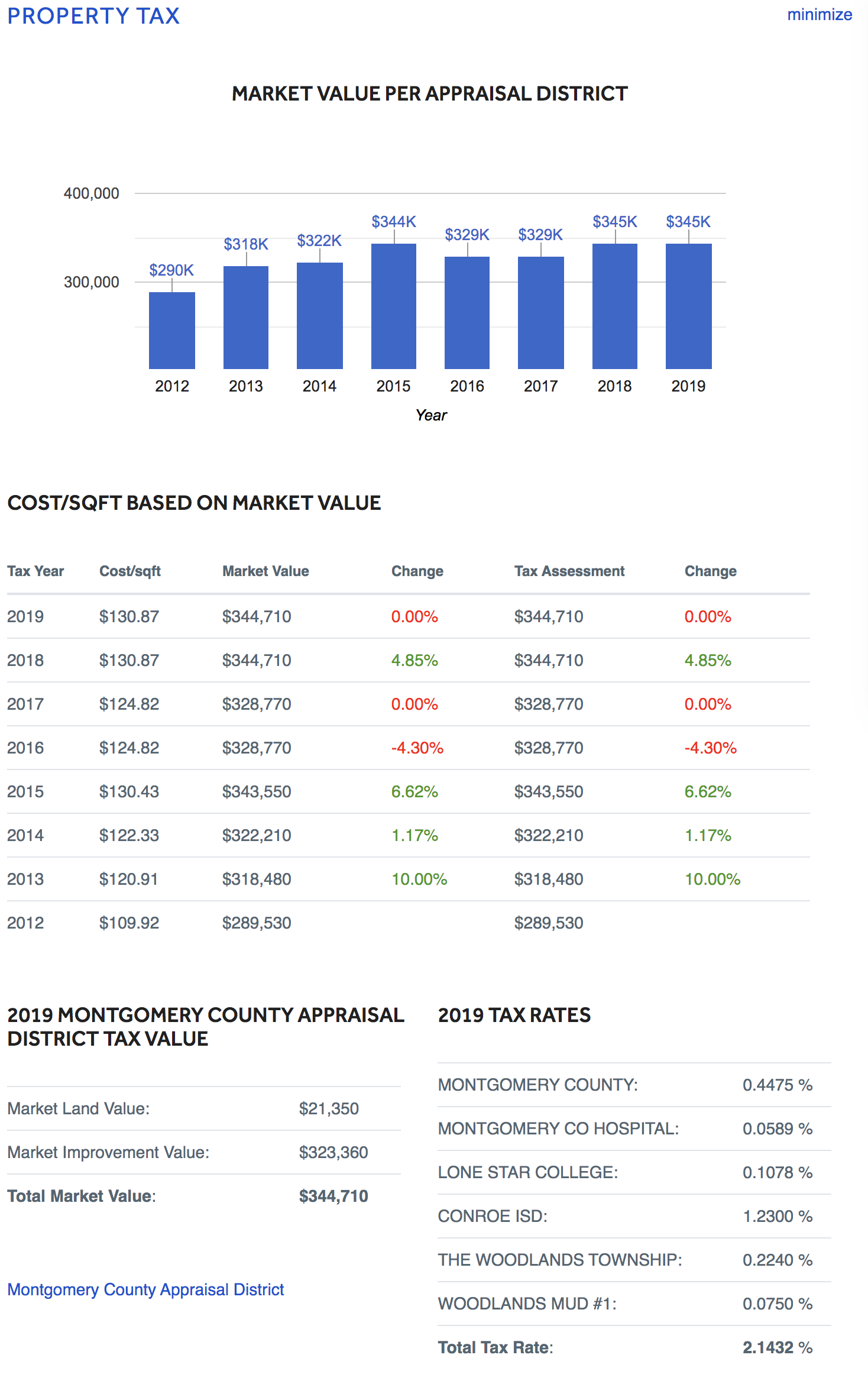

New Construction Neighborhoods With Low Taxes In Montgomery County Har Com